Wise (formerly TransferWise) is a financial technology company headquartered in London, founded by Estonian businessmen Kristo Käärmann and Taavet Hinrikus in January 2011. It is currently one of the most popular international money transfer service companies because it offers fair exchange rates and unique services for people in different regions, such as the ability to apply for a multi-currency account and Wise debit card in most European and American countries. However, Hong Kong users can only use the basic international money transfer service for now.

1.Background introduction to Wise currency exchange tool

Wise (formerly TransferWise) is a UK-based fintech company and an authorized electronic money institution regulated by the UK Financial Conduct Authority (FCA). Founded in 2011, its main business is international money transfer and electronic currency services. As the business continued to flourish, it was renamed Wise and listed on the London Stock Exchange recently. Currently, it can transfer money to 80 countries, and there are region-specific expansion products available.

Wise Kristo Käärmann和Taavet Hinrikus

Multi-currency account: Customers can manage and exchange over 50 currencies simultaneously, and have bank account information for up to 10 currencies including GBP, EUR, USD, AUD, NZD, SGD, and CAD, eliminating the need to open a bank account in a foreign country.

Wise debit card: Breaking geographical barriers, it can be used at Mastercard or Visa merchants worldwide, and is linked to the multi-currency account, allowing for direct deduction of local currency balances when making purchases.

Investment (Assets): Only available to UK customers, they can choose to allocate part of their funds to stocks rather than cash for investment purposes.

In most European and American countries, such as the UK, US, and Canada, customers can enjoy Wise’s most comprehensive services: international remittance, local currency accounts, and Wise Debit cards. In some Asian regions, such as Japan, Singapore, and Malaysia, customers can also enjoy international remittance, multi-currency accounts, and debit cards. However, limited services are available in some areas. Hong Kong users can only make remittances, while users in mainland China, Taiwan, Korea, Indonesia, and Thailand can make remittances and open foreign currency accounts.

2.Advantages of Wise Transfer

It is up to 8 times cheaper than traditional bank transfers for international payments. According to the sample data provided by Wise, the advantage is basically 4-8 times. (reference article) Transaction costs are very transparent and there is no middleman involved in making a profit from the exchange rate. Unlike other providers, who secretly add a markup to the actual exchange rate in addition to charging fees. International payments are typically completed within 24 hours, whereas traditional banks take 3-7 days. In addition, if you have transferred to this account before, the vast majority of payments are completed within minutes. Online transfer is very convenient. Like UK banks, Wise is regulated by the UK Financial Conduct Authority (FCA) and has the trust of over 7 million users worldwide. Your money will be sent directly to the recipient’s bank account. Suitable for both business and personal use.

3.Wise Account Opening Process

3.1 Wise Personal Account Opening Process

Whether you want to use Wise’s remittance service or apply for a Wise debit card while overseas, you need to register a Wise account and complete identity verification. First, log in to the Wise website and click “Register” in the upper right corner of the homepage to go to the account opening page.

Preparation:

ID card/passport Mobile phone number Email address

Registration is very simple, just follow the instructions and prepare the required information. As long as the information is complete, it is basically a straightforward process without any barriers. Pictures are not provided here as it is straightforward.

Step 1: Enter your email address Set up your login email by manually entering it or connecting to your social media accounts such as Google, Facebook or Apple.

Step 2: Choose your account type Wise offers personal and business accounts. Choosing a personal account can usually meet your needs for personal remittances and managing foreign currency.

The business account is designed for corporate customers and comes with special services such as recurring invoices with a selected payment frequency and batch payments for up to 1,000 remittances at a time, suitable for international business operations.

Step 3: Fill in your country of residence Your country of residence will affect the Wise services available to you. We must correctly fill in our place of residence because we will need to fill in the corresponding phone number, and if you intend to apply for a Wise debit card, you will also need to provide a valid shipping address.

Step 4: Verify your phone number Fill in your phone number and receive an SMS for verification. Note that every time you log into your Wise account on a new device, you will need to receive a verification SMS to protect your account from being stolen and keep your funds safe.

Step 5: Set up your login password Follow the instructions to set up your login password with a minimum of 9 characters, including letters and numbers. At this point, you have completed the account opening process, and the system will automatically redirect you to the remittance page. However, before you can officially use Wise services, you still need to verify your email address, fill in personal information, and complete identity verification.

Step 6: Verify your email address, fill in personal information, and complete identity verification Find the verification email in your inbox and click on the designated link to complete it. Then you can go to the account settings to fill in your personal information. You will be asked to complete identity verification when you make your first remittance. For this, you need to take a photo of your passport photo page and take a selfie. Depending on the situation, this process may take a few days, so it is best to allow sufficient time in advance.

3.2 Wise Business Edition Relevant Information

1> Which enterprises are suitable for using Wise’s business version?

The first type is companies with a lot of business dealings or affiliations with the United States.

The advantage of Wise Business is that it provides companies with multiple foreign currency accounts. For example, if your company has business dealings with the United States, using ACH for some US dollar payments is the most convenient and fastest way. Moreover, when receiving payments through Wise Business, the Wire in fee is only $7.5. Compared with bank remittances, which generally start at tens of dollars per transaction, Wise Business is relatively affordable.

The second type is companies with a lot of overseas business.

The advantage of multiple currencies and no monthly fees make Wise Business naturally suitable for trading companies or companies with a lot of overseas business. For example, you can even send Chinese yuan directly to domestic companies without requiring them to have a foreign currency account.

4.Wise Remittance Detailed Steps

4.1 Steps to use Wise Remittance

- On the personal account page of the Wise website, click “Send Money.” Enter the remittance amount, payment currency, receiving currency, remittance/payment method.

- If satisfied with the exchange rate and fees, click “Continue.” Enter the recipient’s bank account details, and choose to send money to yourself, others, or institutions.

- If unsure of the recipient’s bank account details, enter their email address and Wise will send them an email requesting the bank account details.

- Complete identity verification, and then enter the purpose of the remittance. Check the remittance details and proceed to the payment page.

- Choose the payment method, which can generally be a credit card, debit card, or local bank transfer. Enter the card details or log in to online banking to complete the payment.

- Key Features of Wise Transfers

5.1 How Wise Receives Payments

Wise’s payment process is similar to a regular bank account, and after opening an account, you will receive an account in several different currencies (the currencies may vary depending on the country, but generally there are 50+ currencies). You only need to provide the bank account details of the specific currency to the person or company that wants to make the payment, and they can transfer money to you.

Currently, you can receive payments in AUD, GBP, CAD, EUR, HUF, NZD, PLN, RON (only applicable to EEA and Swiss residents), SGD, TRY, and USD.

5.2 Wise Exchange Rates and Fees

Wise’s international remittances use the mid-market exchange rate, which is the exchange rate found through a Google search of the market exchange rate. In contrast, regular banks often use their own exchange rates, which are less transparent and less cost-effective.

When we set the remittance instruction on the Wise website, Wise will lock in the exchange rate for a period of time. On the remittance details page, you will see that Wise must receive the remittance within a certain time limit (such as 48 hours) for the remittance to be valid. The time limit may vary depending on the currency, and may be shortened during public holidays. Therefore, the time displayed on the remittance details page is the actual deadline.

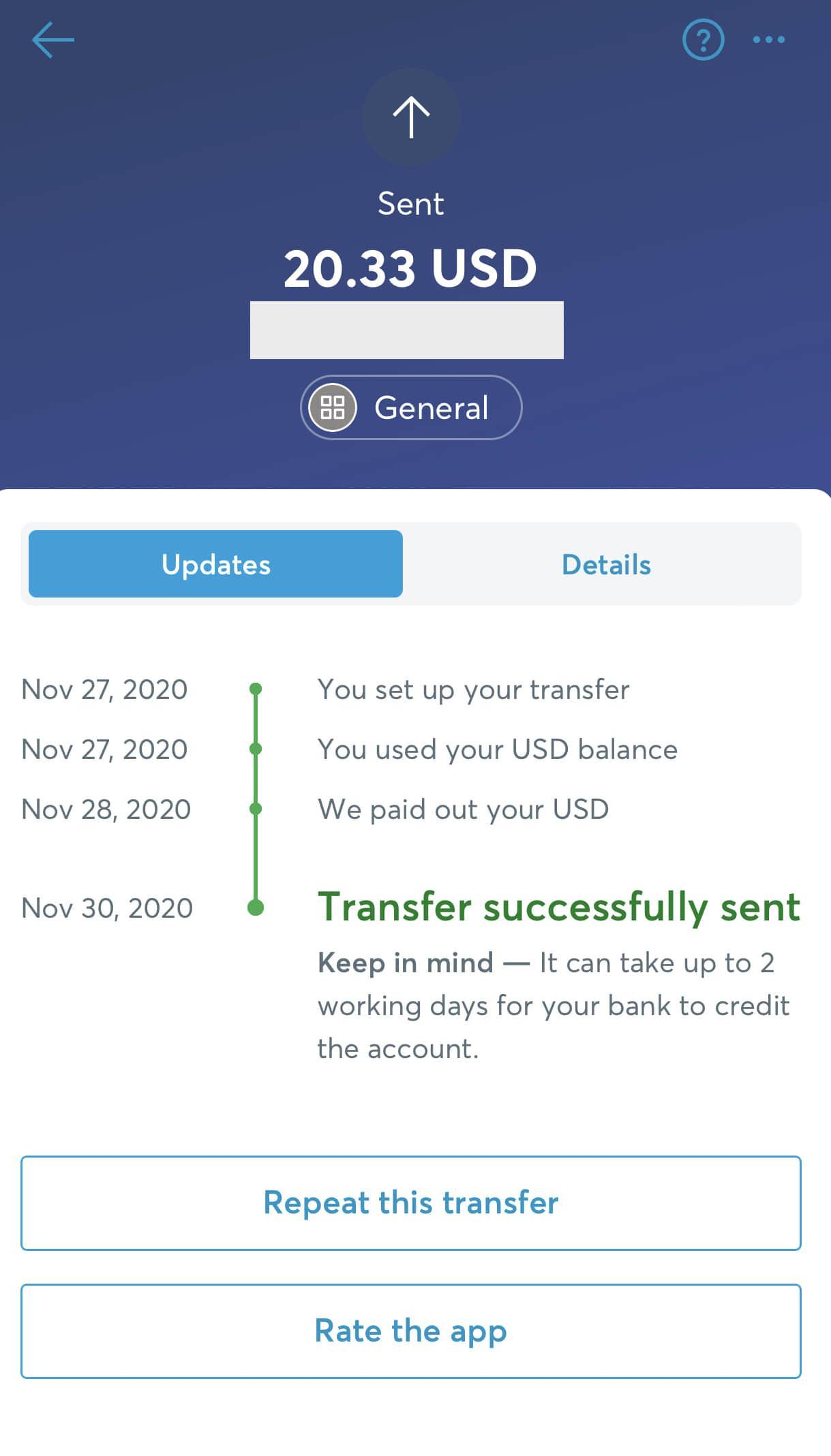

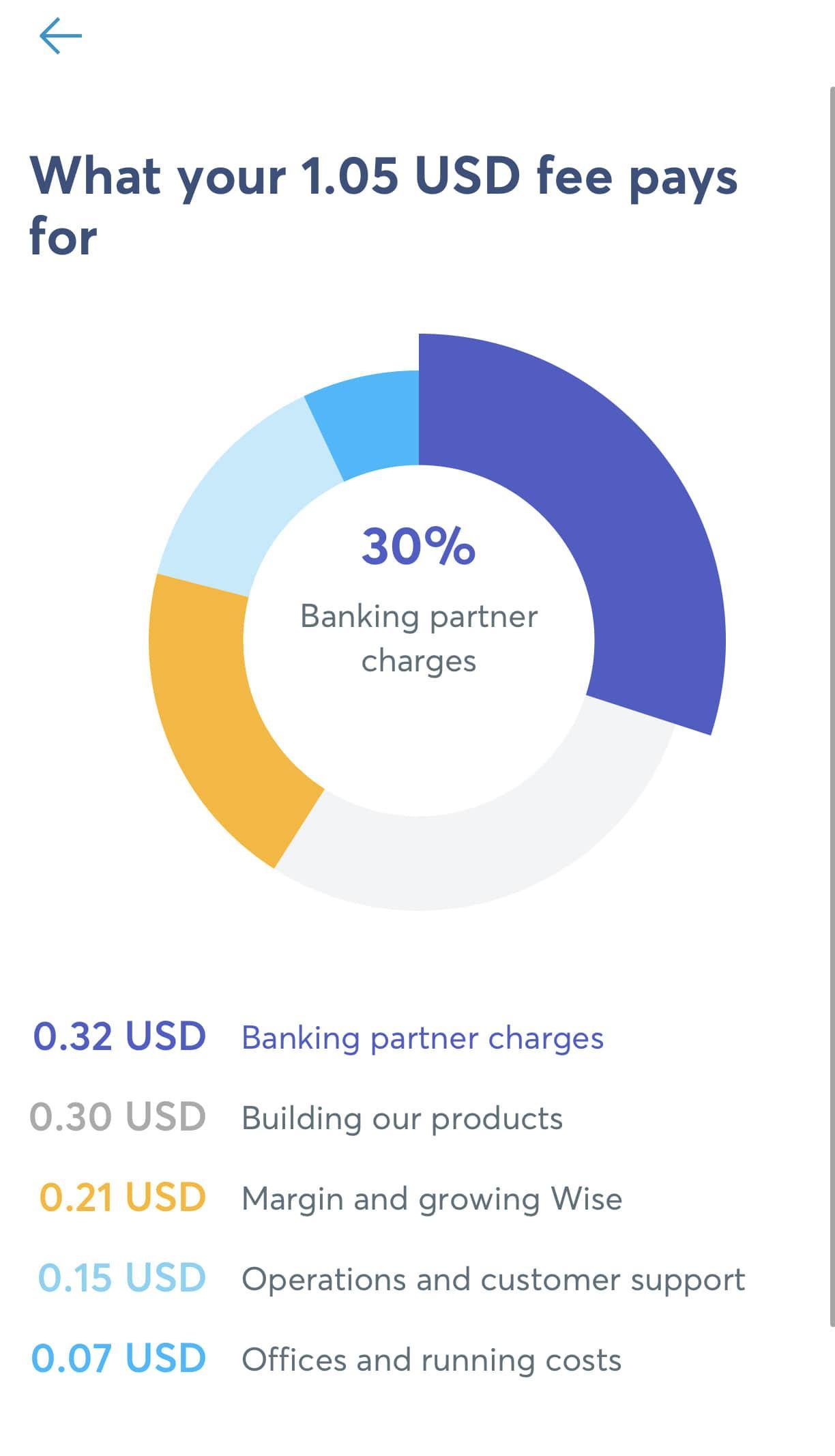

For example, the following remittance of $20.33 to a same-name US account shows a clear breakdown of the fees for each transfer, making it very transparent.

In addition, the remittance handling fee should not be ignored. Generally, when banks use SWIFT remittance, there will be additional fees such as SWIFT fees, OUR fees, third-party bank handling fees, etc., which can confuse the remitter and fear that the recipient will not receive the full amount. Wise only sets a one-time handling fee, which is paid by the remitter along with the remittance amount. The amount received by the recipient is specified and there will be no other handling fees deducted.

Exchange rate:

Basically, the exchange rate of Wise is on par with Google’s exchange rate, even if there is exchange rate fluctuations, there is only a small difference.

Handling fees:

USD account support: Checking account (0.3% handling fee), debit card (1.15% handling fee), credit card (3.7% handling fee), Wire ($5 handling fee);

TransferWise fee – 1.5%, free handling fee for new users who register using an invitation link before $600.

5.3 Wise Remittance Arrival Time

The official statement indicates that the remittance arrival time is generally 8 hours, but it can also be 1-2 hours, or 1-2 days, which may be related to the working hours of domestic banks and remittance methods, but it will not be too long in general. The longest I have tried is 2 days (ACH 48 hours).

5.4 Wise Payment and Collection Methods

If remitted from the United States, four payment methods are supported:

Bank debit (ACH): arrives within 2 hours;

Telegraphic transfer: Use your bank to manually transfer funds to Wise, and then make a manual remittance within 6 hours;

Debit card: arrives within 2 hours;

Credit card: arrives within 2 hours.

The handling fee for each method can be seen below. This fee is for reference only, but overall, the handling fee for credit cards is the highest, followed by debit cards, and then bank checking accounts.

Wise supports the following two collection methods, which vary depending on the recipient’s country, and some collection methods only apply to certain countries/regions.

Bank transfer (for China, it is UnionPay card collection)

Mobile wallet (such as Alipay)

5.5 Wise Remittance Limit

Recipient:

Here, it is emphasized that the recipient in mainland China must comply with the annual $50,000 USD foreign exchange limit. All transfers are counted towards this limit, including those sent using services other than Wise. If you need to transfer more than $50,000 USD worth of money to friends and relatives in China, it is recommended to create multiple recipients, each of whom can receive up to $50,000 USD worth of money. Wise has very clear regulations on this. If the receiving currency is Renminbi (CNY), the value of a single transfer cannot exceed 50,000 CNY.

Remitter:

Wise does not have a clear transfer limit document, but like all transfer services, these limits will also vary by country and region. Taking the United States as an example (details):

The single limit for most users in most regions is $1 million USD, and to reach this scale, Wire transfer is estimated to be the only option.

If paid with ACH, the single limit is $15,000 USD.

The 24-hour limit for debit or credit cards is $2,000 USD, and the 7-day limit is $8,000 USD.

Wise’s official documents mention the latest single limits for several common currencies. Ref: this updated article.

- EUR – 165,000 EUR

- AUD – 260,000 AUD

- CAD – 240,000 CAD

- CHF – 180,000

- CHF — 180,000 CHF

- DKK — 1,200,000 DKK

- HUF — 57,000,000 HUF

- HKD — 1,500,000 HKD

- NZD — 280,000 NZD

5.6 Supported Sending Countries/Regions:

Currently, Wise supports over 80 countries/regions for sending money (list), including the commonly used countries/regions for Chinese international students and overseas Chinese mentioned above, as well as countries/regions that only support receiving money, such as Vietnam, South Korea, Israel, India, the Philippines, and Russia.

5.7 Supported Receiving Countries/Regions:

Wise users in countries such as the United States, United Kingdom, France, Germany, Italy, Spain, Canada, Australia, Sweden, Norway, Denmark, Singapore, Hong Kong SAR China, Japan, Malaysia, and Indonesia can register and use Wise’s remittance service. Latest list available.

6. Common Questions about Using Wise for Currency Exchange

6.1 Is Wise a bank?

No, Wise is not even a digital bank. To be precise, Wise is an electronic currency institution that provides currency exchange services.

6.2 Is Wise safe?

Yes, Wise is safe. The following factors can be used as a reference:

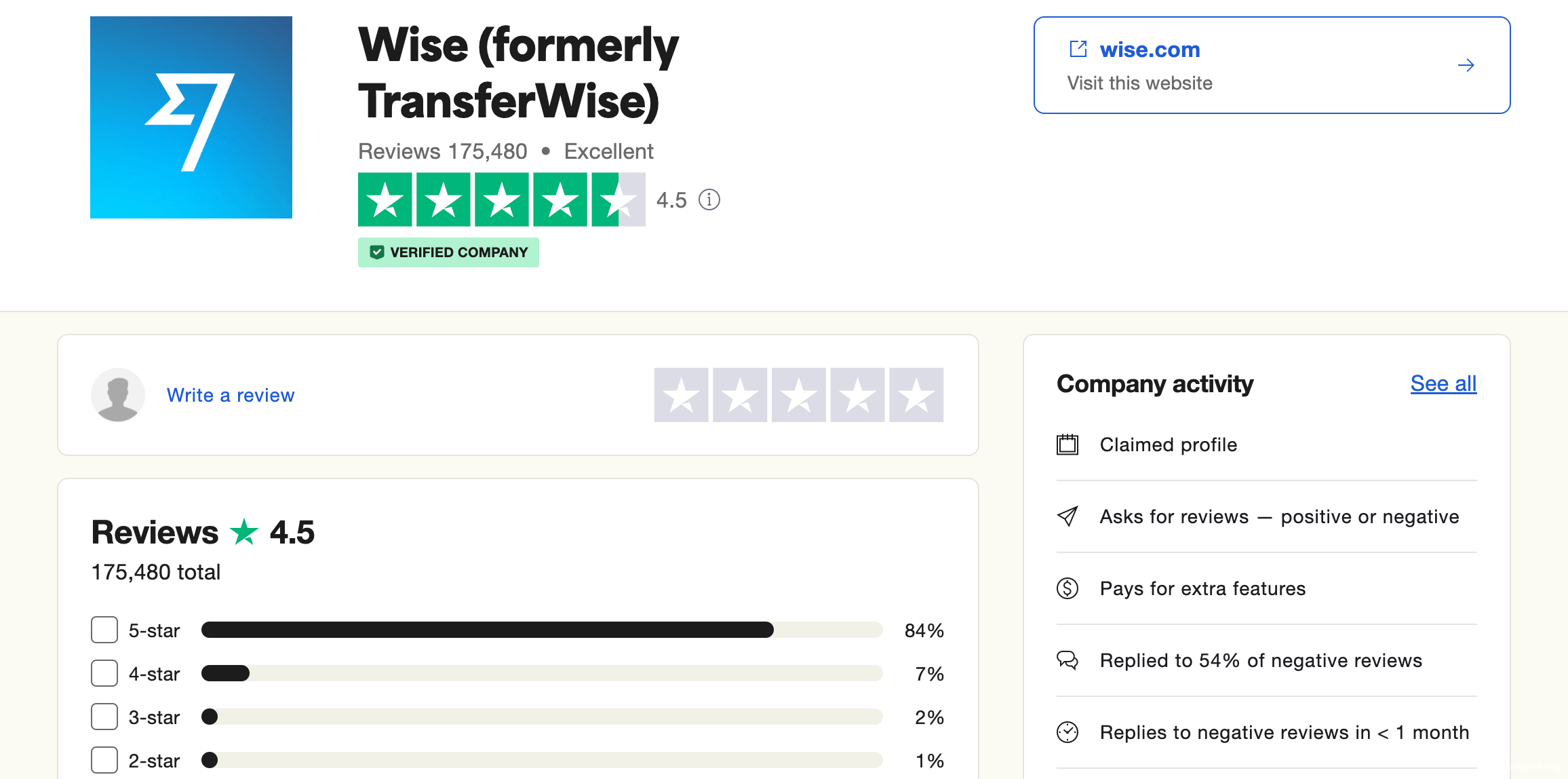

1> The company has been in operation for more than 10 years and has processed many remittances. Trustpilot gives a rating of 4.5 based on 175,480 samples, which is in the excellent range.

2> As a global remittance company, Wise is regulated and authorized by local agencies around the world.

This means that Wise must comply with global financial service regulations and take appropriate security measures to ensure the safety of customer funds. One key measure is that Wise separates operational funds from customer remittance funds. Customer funds are always stored in low-risk financial institutions such as JPMorgan Chase, Barclays, and Deutsche Bank, and are not affected by Wise’s own financial situation.

Australia: Australian Securities and Investments Commission (ASIC), Australian Prudential Regulation Authority (APRA) Canada: Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), Autorité des marchés financiers (AMF) United Kingdom: Financial Conduct Authority (FCA) United States: Financial Crimes Enforcement Network (FinCEN), Office of the Comptroller of the Currency (OCC) Hong Kong: In Hong Kong, Wise is a licensed money services operator (MSO) regulated by the Customs and Excise Department (CCE).

6.3 Is Wise legal and compliant?

Wise is a legal and secure international remittance company headquartered in the UK and listed on the London Stock Exchange. With over 10 years of experience, Wise has successfully completed billions of dollars in remittances for over 13 million individuals and businesses worldwide.

Wise’s remittance is often cheaper than traditional banks because Wise uses a no-markup market exchange rate, which is the same as the rate shown on Google and does not hide any fees in the exchange rate. Wise is able to offer low-cost remittance services because it has its own remittance network and uses a more direct remittance model.

6.4 Can a person have multiple Wise accounts?

No, each person can only have one personal account. If you have a business, you can open a separate business account for each business.

6.5 Can the registered address be changed from the current country to another country or region?

Yes, in general, you can easily change your address on the Wise website or Wise app. If necessary, Wise may ask you for proof of address to verify your identity.

6.6 Are there any promotions for new Wise registrations?

Yes, there are promotions for new registrations. You can use the following promotional link to enjoy the promotion and get the first £500 transfer free of charge.

Wise utilizes innovative remittance methods, streamlining the multiple steps involved in traditional bank transfers. The remittance process and service charges are also more transparent, with the entire process trackable on the website or Wise app. By inputting the remittance amount on the Wise website, the required fees, exchange rates, and expected arrival time can be automatically calculated and easily understood. If you have moved overseas and are interested, you can also check out Wise’s multi-currency accounts and debit cards.