In layman’s terms, SWIFT is a bunch of banks leaving behind the post and telecommunications system and making a telegraph system by themselves, through which business information is transmitted between each other. Because the price is cheaper than the post office, the efficiency is higher than the post office (the transceiver is within each bank, so there is no need for the postman to transmit), the security (the loss in the transmission process is reduced), and the standard (according to the characteristics and needs of the banking business, the message format is unified), almost all banks that start international business have joined this system. What is transmitted in this system is business information between banks and related information of interactions, including information on cross-border settlement of enterprises and cross-border clearing information between banks (payment clearing instructions). But it is not the currency payment, settlement, or clearing itself.”

“In addition to SWIFT, a small portion of interbank information exchanges are still transmitted by mail, either through the postal system or through the emerging courier system.”

“Payments, nowadays, generally refer to direct monetary payments between individuals, between institutions, and between individuals and institutions.”

“Settlement, refers to the transfer of payments between businesses and individuals through bank accounts.”

“Clearing, is the bank transfer settlement of mutual funds transactions. Each country has its own local currency clearing system. Some countries also have domestic foreign currency clearing systems. For internationally circulating currencies, each issuing country establishes a cross-border clearing system, either unified with the domestic clearing system or separate domestic clearing system and cross-border clearing system. For example, in addition to a domestic RMB clearing system, China also has a domestic foreign currency clearing system and has established a RMB cross-border clearing system (CIPS). Not all banks have direct access to the cross-border clearing system; only the clearing banks designated by the central bank can access the cross-border clearing system, and other banks open accounts with the clearing banks for clearing.”

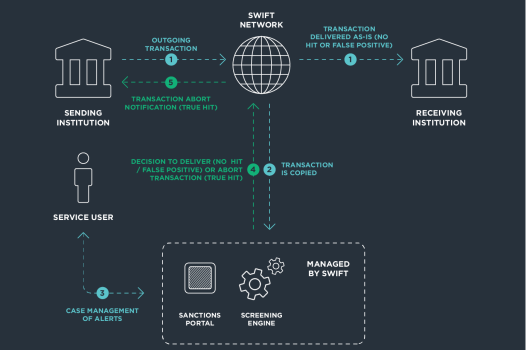

“For cross-border settlement and cross-border clearing of U.S. dollars, most of the information for settlement and clearing is transmitted through SWIFT, but the settlement and clearing of U.S. dollar funds is done through U.S. dollar clearing banks and the U.S. dollar clearing system. The two should not be confused.”

There are still some friends who have different views, and even some friends who do specific business still think that SWIFT and the dollar clearing system are one and the same. This is a sign that business people know what they know but do not know what they know about specific business. Because now in the post to do international settlement and clearing business friends, most of the start to do this business is to use SWIFT, so in their eyes, do international settlement and clearing, is done through SWIFT.

The clearing system is a set of bank account system and accounting rules for mutual fund transfer and delivery. The funds are cleared and require valid documents and instructions as a basis, that is, business information. The way these information are transmitted can be specified or individually chosen. Some clearing systems and information delivery methods are united, such as our domestic large-value payment system. Most are separate, and SWIFT is one of the banking information delivery methods.

There are separate systems for clearing, such as our large-value payment system, the RMB cross-border payment system (CIPS), and the U.S. dollar clearing system, also known as the New York Clearing House Interbank Payment System (CHIPS). In this system, there are designated clearing banks. Some countries or regions, in order to regulate the order of foreign exchange clearing within the country or the region, will also specify the specific currency clearing bank. In addition, within a certain region, in order to improve the efficiency of foreign exchange clearing within the region, many small banks will spontaneously use a certain big bank as the account bank for foreign currency clearing within the region.

Not to say before there is SWIFT. After the establishment of SWIFT, not all banks joined at once, but gradually joined through waiting and testing. Chinese banks also all joined the SWIFT system gradually. Before joining SWIFT, the transmission of international settlement business information was mainly through the post and telecommunications system. Before we had the People’s Bank of China’s large amount payment system and small amount payment system in China, the inter-bank clearing method also went through several changes with the development of technology. International settlement of remittances, letters of credit, etc., divided into telegraphic transfer, letter remittance; electric opening certificate, letter opening certificate.

In domestic settlement, also divided into wire transfer, letter transfer. Then called business varieties, now called products. These product names illustrate that business information is dependent on the transmission of the post and telecommunications system. For this reason, the bank at that time also arranged special post office running positions. In co-location clearing, each bank sends its clearing bills to the bill exchange center of the People’s Bank, and each bank has the post of bill exchanger. This example shows that banks’ clearing information can be passed on by themselves in person.

In international settlements, banks had to establish correspondent bank relationships with each other to exchange cipher and signature specimens, cipher for telegraphic and telex (SWIFT) and signature specimens for paper documents. This is still the case today. Because, even though most banks are now part of the SWIFT system, not all international settlements and clearings transmit information through SWIFT, and there is still a certain amount of paper information that cannot go through the SWIFT system. Of course, there is no document or law stipulating that international settlement and clearing, must pass information through SWIFT.

So, it can be said that SWIFT is a sufficient condition for international settlement and clearing, but not a necessary condition, not the international clearing system itself.

Around 1995, we cooperated with a Chinese bank in New York to send remittances to overseas Chinese. At that time, there were many people who went to the U.S. for work and study, especially some part-timers, who often borrowed loan sharks to go abroad before going out, so they were eager to remit money home after getting their salaries every week. However, some big banks are cumbersome, slow and expensive to handle the business. This bank saw this market and acquired customers with relatively low fees and simple procedures, but the speed problem was still not solved. We discussed with it that the funds could go through the US dollar clearing system in bulk, and the personal information of the recipient could be transmitted directly to my relevant branch first in Chinese by telephone fax, and the branch would pass the information to the relevant branch, which would then notify the recipient to withdraw the funds. Such a change to the operation greatly accelerates the speed of remittance, and because it is in Chinese, it also improves the accuracy rate. Because the general international settlement transmission information is in English, Chinese addresses and names are easily confused using pinyin. This bank was thus instantly freed from the difficulty of making ends meet and established a good brand image among the local Chinese community. As business volume grew and profitability improved, we suggested that they join SWIFT to better improve the efficiency and capacity of their services. When I visited New York in the second half of 1997, the bank had already joined SWIFT. it is thus clear that the method of transmission is optional, as long as the credentials for settlement and clearing are recognized as valid by both parties.

The reason why SWIFT has developed to such a point of almost unification is the result of market choice. The market starts with observation, then acceptance, and finally becomes you are behind if you do not join. This process is similar to that of VISA and Alipay, etc. SWIFT’s own technology is constantly being upgraded, and its business processes and rules are constantly being improved, always following the needs of banking business development. The system is becoming more and more open and can easily access to various clearing systems and business systems of various banks. At the same time, each bank itself is constantly investing in technology and improving its processes. Initially, SWIFT messages had to be processed on the ground, and accepted messages had to be printed out for business departments to process; messages from business departments had to be specifically entered into the SWIFT system. Now, most banks are able to process messages without landing.

SWIFT is an open system for interbank business, not only for USD. Most of the settlement and clearing of RMB, EUR, JPY, etc., also pass messages through this system. Our RMB Cross Border Payment System (CIPS) accepts SWIFT messages.

Is it possible for SWIFT to be subverted? Of course it is possible. There are generally two circumstances under which such a public facility-type system will be subverted. One is that, due to technological updates, it is possible to provide a more efficient, secure, simple, professional and cheaper service than SWIFT. In the second case, it loses credibility as a third-party service provider. For example, they themselves also do first-party or second-party business, or possess customers’ information and data for profit, or channel benefits to fourth parties, etc. However, disruption is often a relatively long-term process and cannot be achieved overnight. The special case, which may subvert SWIFT at once, is that most countries prohibit their banks from using SWIFT system by executive order or decree.

Currently, after several days of hesitation and consultation, the United States, the European Union and some countries have announced that they want to exclude individual Russian banks from the SWIFT system. This will be a major event in the world financial history. Finance is never a purely economic affair, and this event shows that SWIFT, as a public facility in the financial sphere, can eventually be reduced to a political tool, although its origins are purely commercial. It remains to be seen and evaluated to what extent this incident will ultimately have an impact on international trade and financial transactions in Russia and more broadly.

As a public infrastructure, SWIFT needs credibility to maintain its long-lasting operation. Since its establishment, SWIFT has undoubtedly been very successful in building its own credibility and has won the trust of commercial banks around the world. However, as a specific economic entity, it needs to be bound by the laws and regulations of the country where it is located. In the case of SWIFT, its business strategy is determined by the Board of Governors. At the same time, as a Belgian company, it needs to be regulated by the relevant Belgian laws. And since Belgium is a member of the European Union, SWIFT is also subject to the relevant EU laws. In addition, as a company, it is also subject to the long-arm jurisdiction of the United States. It is for this reason that the US and the EU were able to announce so justifiably the exclusion of Russian banks from the SWIFT system.

Laws and regulations have two sides. When they are imposed on an international institution in the name of anti-terrorism, anti-drug trafficking, anti-money laundering, etc., it has a positive effect on the credibility of the international institution. When laws and regulations impose requirements for national political purposes against other countries, it has a destructive effect on the credibility of international institutions. In this case, even commercial banks in Europe and the United States will have the need to diversify their cross-border clearing risks. The competition to explore an effective and secure cross-border clearing system outside the SWIFT banking information transmission system and the U.S. dollar clearing system has begun in recent years. This action by the U.S. and the EU will undoubtedly accelerate the process.